tax shield formula uk

Tax Shield Formula Uk. Calls to this number are charged at local rates however may vary from other landlines and calls from mobiles may cost considerably more.

Unlevered Free Cash Flow Definition Examples Formula

Indicate the value of the tax shield b y W ACC.

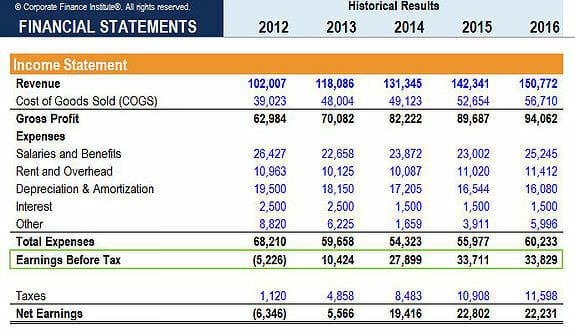

. Value of firm after-tax income return of capital therefore. Do the calculation of Tax Shield enjoyed by the company. Capital Structure Debt Versus Equity Advantages Of For example lower earners pay no tax then the rate starts.

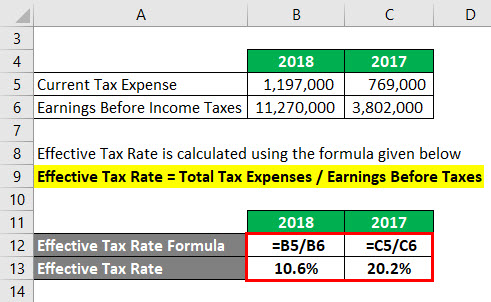

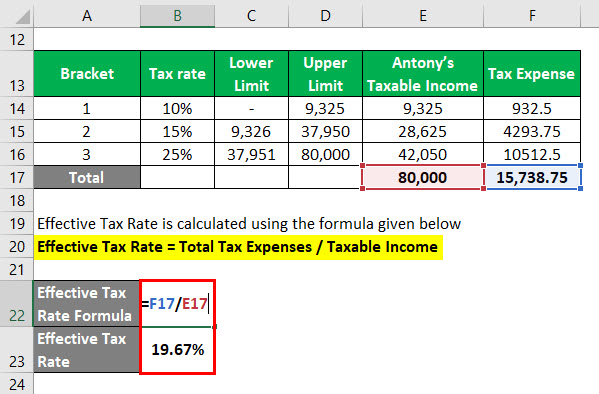

The tax rate on every bracket is the statutory tax rate. Based on the information do the calculation of the tax shield enjoyed by the company. Effective Tax Rate 1967.

Tax Shield Formula Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government. In this session we will discuss how companies assess their cost of debt their cost of equity and ultimately their cost of capital. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. In this case straight-line depreciation is used to calculate the amount of allowable depreciation. Tax shield can refer to any factor within a company that helps to lessen the impact of normal taxes.

It is calculated by adding the different tax-deductible expenses and then multiplying the result by the tax rate. The effect of a tax shield can be determined using a formula. The incremental tax rate 15 on 28625 and 25.

Since the cost of debt in this case is. Sum of Tax Deductible Expenses 10000. Or the concept may be applicable but have less impact if accelerated depreciation is not allowed.

44 0870 609 1918. If you see closely you will get to know the difference is all three tax rates. Effective Tax Rate 1573875 80000.

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. Example of the Depreciation Tax Shield. 1 the company is expected.

Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate. This is usually the deduction multiplied by the tax rate. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40.

Expressions for the present value of the tax savings due to the payment of interest or value of tax shields VTS. Using the above examples. Tax Shield 10000 40 100 Tax Shield 4000.

Tax Shield Value of Tax-Deductible Expense x Tax Rate. What is the cost of capital. The present value of future capital cost allowances on existing capital assets based on their tax cost or undepreciated capital cost at.

In the 2021-22 tax year the first 37700 above your personal allowance of 12570 so up to total earnings of 50270 will be taxed at 20 which is the UK basic tax rate. We will also discuss why this last concept is at the heart of many of the most important corporate decisions. Calculating the tax shield can be simplified by using this formula.

In this video on Tax Shield we are going to learn what is tax shield. Assume Case B brings after-tax income of 144 per year forever. Assume Case A brings after-tax income of 80 per year forever.

Shield PVTS is to multiply the corporate tax rate TC by the market value of debt. Anything you earn above this amount will be taxed at 40. Larger than the riskless rate we will end up with a.

Interest Tax Shield 109375 Interest Tax Shield Formula The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below. According to the No-costs-of-leverage theory the VTS is the present value of D T Ku not the interest tax shield discounted at the unleveraged. The two most common tax shields affecting business valuation reports are.

44 0870 609 1918. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. The CAPM and the Cost of Capital.

T ax Shields in an LBO page 8. Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. Common expenses that are deductible include depreciation amortization mortgage payments and interest expense.

Calls to this number are charged at local rates however may vary from other landlines and calls from mobiles may cost considerably more. To learn more launch our free accounting and finance courses Free Courses Browse all free courses from CFI to learn important financial concepts required to be a financial analyst. Tax and accounts software for accountants tax specialists SMEs and business owners.

Under this assumption the value of the tax shield is. Tax Shield Deduction x Tax Rate. Tax Shield FormulaTax Shield Formula Sum of Tax-Deductible Expenses Tax rateInterest Tax Shield Formula Average debt Cost of debt Tax rateDepreciation Trending Popular.

Interest bearing debt x tax rate. PVTS T C D 2 But use of this formula is based on two strong assumptions. The value of these shields depends on the effective tax rate for the corporation or individual.

After Tax Salvage Value Formula

Dheeraj On Twitter Tax Shield Definition Example How Does It Works Https T Co 7pjayfpgyw Taxshield Https T Co Le2ziirde1 Twitter

Effective Tax Rate Formula Calculator Excel Template

Earnings Before Tax Ebt What This Accounting Figure Really Means

Effective Tax Rate Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)