how to find bull flag stocks

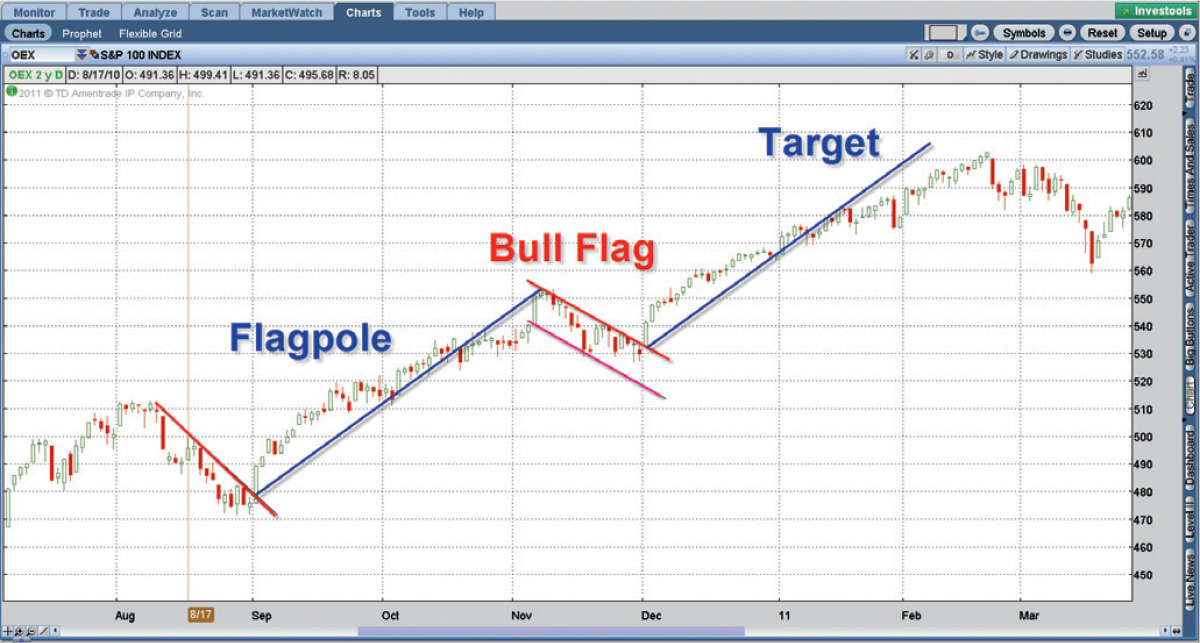

Look for a strong trending move This means the range of the candles are more bullish than usual and they tend to close near the highs. They should last three days to three weeks.

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

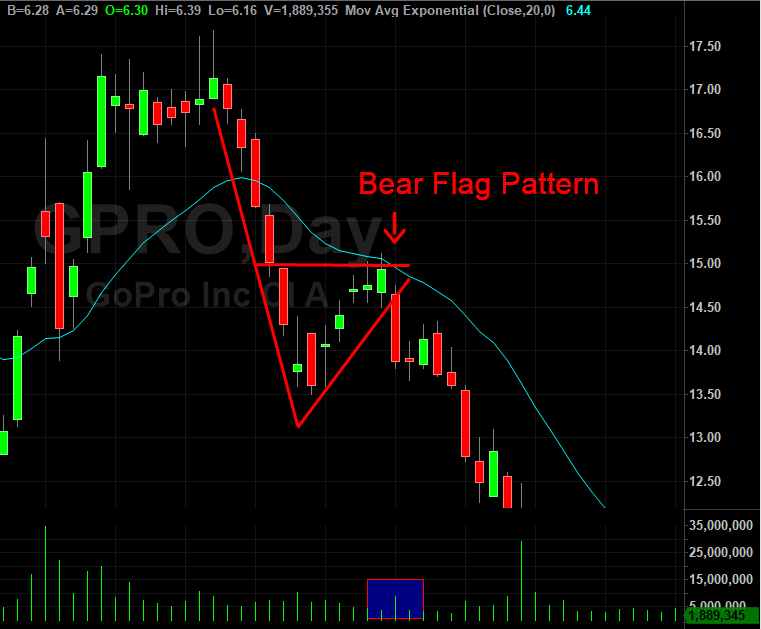

The bear flag starts with a significant fall in prices followed by a period when the price remains between 2 lines.

. Bull flags are fire - I have had. The first entry is on the flag break and the second potential entry is on the break of the high of the flagpole. Look for volume dry up while the pattern forms.

It is thought that the bear flag suggests the price will continue to move downward once it leaves the area between the 2 lines. Its screener has built in predefined function that can find stocks with Flags or Pennants. 1 Investar software 5.

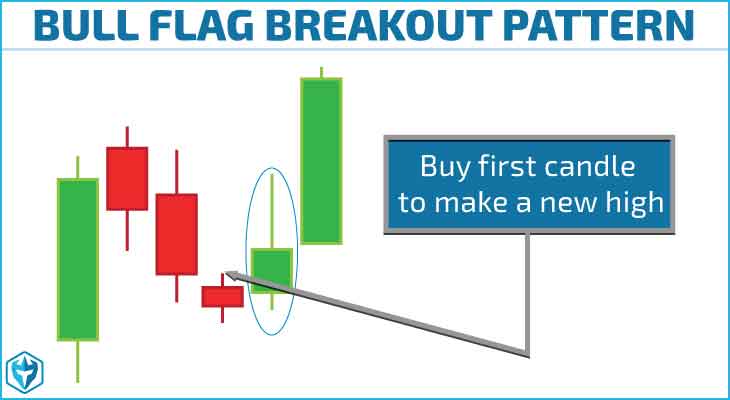

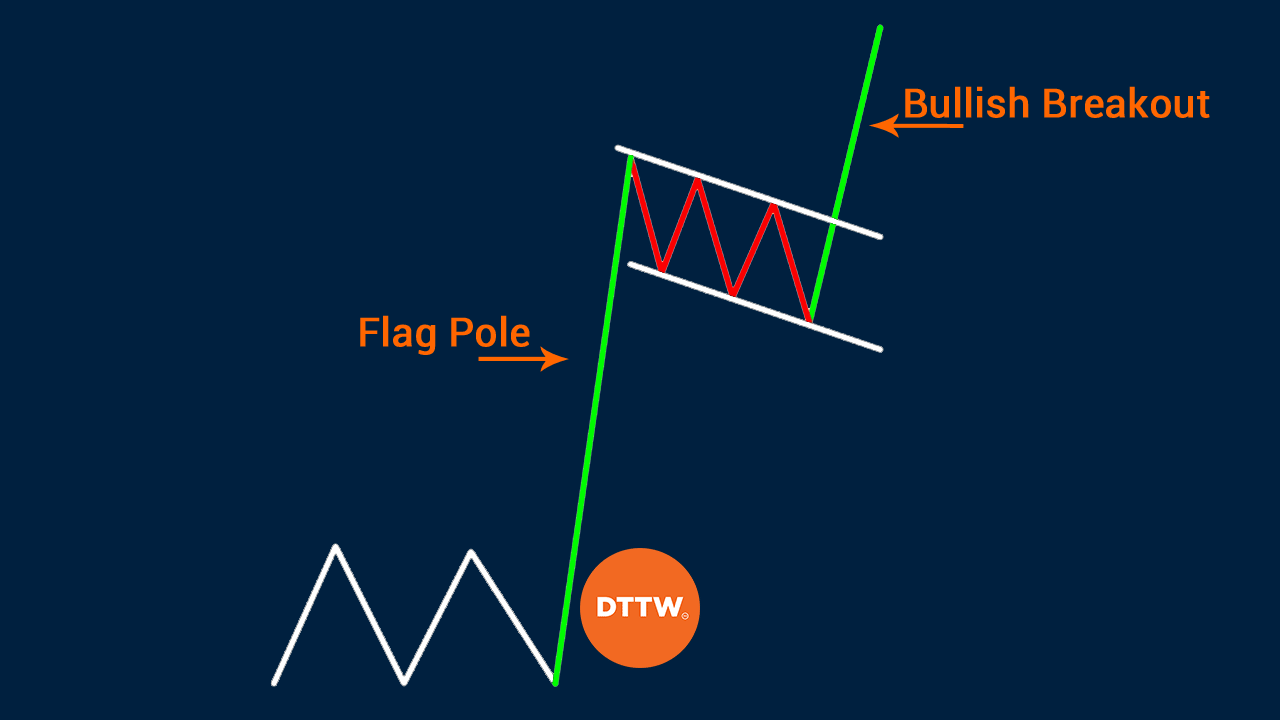

Preceding uptrend flag pole Identify downward sloping consolidation bull flag If. However the pattern is saying that the price is about to go uptrend. A bull flag is a continuation chart pattern that signals the market is likely to move higher.

Hey everyone what are your thoughts on this type of video. Instead you may find it on any period such as M1 H1 W1 and MN. For example the bull flag pattern is where the flag part of the pattern seems to be pointing downwards.

After the strong move higher the market needs to take a break. Stay tuned for my 3 st. This designation depends on what the flag says about where the price is headed.

92 Remember That Stocks Can Offer You a Second Entry Chance. They are pretty rare outside of penny stocks which tend to be less reliable. Flags and pennants require evidence of a sharp advance or decline on heavy volume.

83 Bull Flag vs. It is suited for swing and daytrading. Stocks On Fire.

It helps clients find an optimal entry. Screening for Intraday BULL Flags on Indian Stock Market. Watch for a bullish candlestick that forms a flag pole.

Tomorrow buy 10 cents above todays high. When I tested scan for bull flag pattern in stocks with average volume above 300K returned only five results as you can see below. How to trade bull flag patterns.

A bull flag is a consolidation pattern after a strong move up. The price of the stock often surges 15 30 50 even 100 or more out of this pattern. A bull flag is a continuation chart pattern that signals the market is likely to move higher.

Yesterdays close must be in the bottom 25 of the daily range. The bull flag is an easy-to-learn pattern that shows a lull of momentum after a big rally. But today it can be different.

It consists of a strong rally followed by a small pullback and consolidation. What would be the best time frame option for that scan for swing trading. When you see the graphical representation of this pattern youll notice that it somehow looks like a flag on a pole.

Today we talked about screening stocks and finding good bull flag patterns. And the rally needs high volume. The pattern formed by inverting the bull flag stock pattern is called the bear flag stock pattern.

The parts of the flag pattern are three. To trade this strategy on stocks with NSE you need. To trade this strategy on stocks with NSE you need the below setup to identify bull flag pattern while they are still forming.

After the strong move higher the market needs to take a break. The bull flag has the following pros and cons. When the lower trendline breaks it.

Most easily seen on the daily chart. Heres what to spot one. The pattern takes shape when the stock retraces by going sideways or by slowly declining after an initial big rise in price.

Watch if price can break above high of flag pole. It has the same structure as the bull flag but inverted. Todays close must be in the top 25 of the daily range.

A follow-up rally is likely when combined with other bullish indicators. Look for at least 3 or more consolidation candles that hold support levels. They are called bull flags because the pattern resembles a flag on a pole.

You can use other properties to dial it in. This means the range of the candles are more bullish than usual and they tend to close near the highs. 93 Know the Importance of Using a Stop Loss.

There is no specific timeframe to spot the bull flag. The flag pattern can be bullish or bearish. RUN IN STOCK SCREENER.

A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends. Bull Flag Pattern Checklist. The bear flag is an upside down version of the bull flat.

Add a new filter for Pattern and you can select FLAG. Once price breaks above the last smaller consolidation candle take entry at break of high. 9 My Tips to Use This Strategy on Day Trades.

95 Master Your Skills with a Trading Mentor. Pros and Cons of Bull Flag. Learn how to find Bull Flag technical patterns in stocks.

Using Investar Stock Screener. I was trying to do 1yr 1day but it doesnt have it. 91 Pay Attention to the Resistance.

Screening for Intraday BULL Flags on Indian Stock Market. They go against the prevailing trend. It appears during a price advance.

94 Follow the Price Action. The trading strategy in this article is based on a breakout from the Bullish Flag Pattern and can be applied to any timeframe. A practical Trading Guide for the Bull Flag Pattern.

Key things to look out for when trading the bull flag pattern are. Basically despite a strong vertical rally the stock refuses to drop appreciably as bulls snap up any shares they can get. Look for an increase in volume on the breakout day.

Look for a strong trending move higher. Rules via Hit Run Trading. The flagpole forms on an almost vertical panic price drop as bulls get blindsided from the sellers then a bounce that has parallel upper and lower trendlines which form the flag.

Today stock must close above both its 10-day and 50-day moving averages. It is a bullish continuation pattern. If the flag portion of the pattern develops a consistent downtrend its often called a bull pennant pattern because the flag has a triangular shape.

Traders may find it while trading any market including forex stocks indices cryptocurrencies etc.

Bull Flag Price Action Trading Strategy Guide 2022

Bullish Flag Chart Patterns Education Tradingview

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Are You Taking Advantage Of These 3 Bull Flag Patterns

Bullflags Education Tradingview

Bull Flag Trading 12 Epic Tips Trading Strategies

How To Trade Bullish Flag Patterns

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Bullish Flag Chart Patterns Education Tradingview

How To Trade Bull Flag Pattern Six Simple Steps

Learn Forex Trading The Bull Flag Pattern

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw

Stock Charting Tips Leading The Charge With Bull Fla Ticker Tape

A Market Signal Bull Flags Ascending Triangles And Ticker Tape

How To Trade Bullish Flag Patterns

:max_bytes(150000):strip_icc()/dotdash_Final_Flag_May_2020-01-337783b3928c40c99752093e6cb03f6d.jpg)